Australia’s Oil Vulnerability – The Key Trends

Yesterday I looked at Australia’s decline in oil self-sufficiency, a trend that is set to continue into the future. Today, it’s time to look at another significant trend likely to affect Australia’s oil vulnerability: the decline in domestic refining capacity.

2. Declining Domestic Refining Capacity in Australia

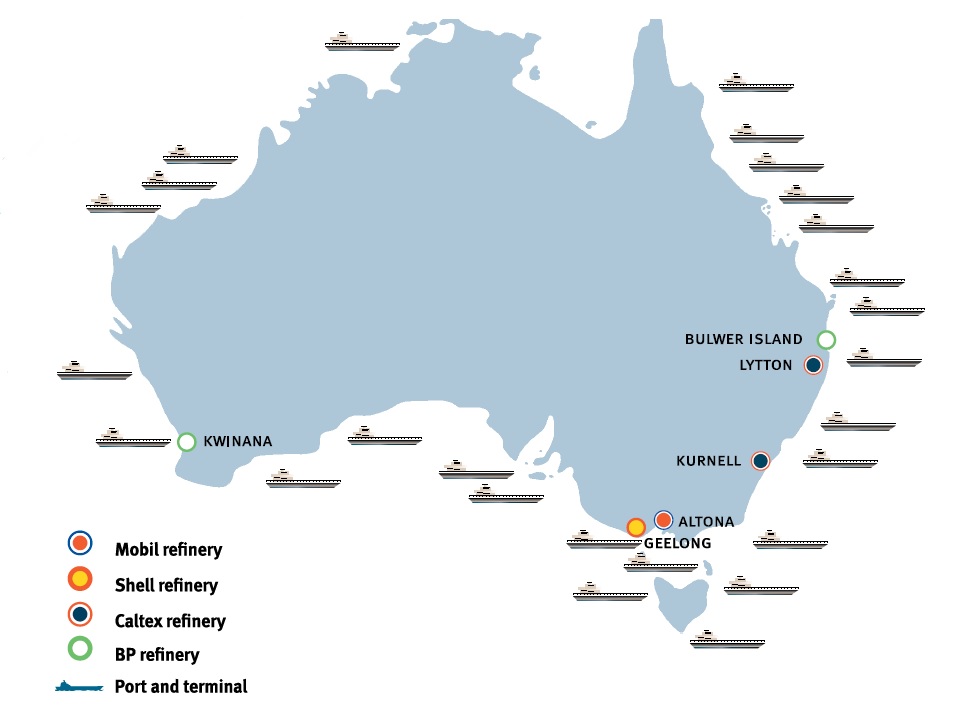

The majority of Australia’s refining capacity is located close to the major consumption markets on the east coast. Crude oil feedstock for these refineries comes in part from domestic oil produced in the Bass Strait, but mostly from increasing quantities of imports.

Australia’s six refineries are small compared to the larger, more efficient refineries being established in the Asian region, resulting in increased competitive pressures on refining operations in Australia. This competitive disadvantage has resulted in the decision by some operators to close certain facilities and convert them to oil product import terminals.

Figure 1: Liquid fuel infrastructure in Australia.

Shell shut down the Clyde refinery, located near Sydney, in late 2012 and sold its Geelong refinery to Vitol in 2014. Additional planned closures of Australian refineries include Caltex’s Kurnell refinery by mid-2014 and BPs Bulwer Island refinery in mid-2015. Once the closures are complete, Australia will be left with only four refineries, equating to a reduction in domestic refining capacity of 42 per cent since 2011. Any further rationalisation of domestic refinery capacity will further increase the proportion of refined products sourced from overseas.

Concerns have been raised that the reduction in Australia’s domestic refinery capacity could negatively impact on domestic energy security. A report from Australian Strategic Policy Institute (ASPI) contends that closure of domestic refineries removes Australia’s ‘capacity to divert oil exports to domestic consumption in the event of a disruption.’ The NRMA’s latest report on Australia’s Liquid Fuel Security also suggests that Australia would ‘no longer have any liquid fuel supplies that could be considered secure, and … would lose the option to resurrect some or all of [its] local liquid fuel supply chain as part of a solution to a crisis.’

The Age queried:

‘With dwindling refining capacity, how would Australia cope if petrol supplies were suddenly cut off by a war, natural disaster or other catastrophe?’

In 2012, Department of Resources, Energy and Tourism (DRET) commissioned the National Energy Security Assessment (NESA) Competitive Pressures on Domestic Refining report to consider the energy security implications of having less refineries operating in Australia. It concluded that despite the closures, ‘supply chain diversity and flexibility is retained which provides continued security of supply. Only in the unlikely scenario of no refining sector coupled with a failure of physical oil markets does Australia lose the flexibility to redirect and refine some crude oil.’

Similarly, the House of Representatives 2013 report on Australia’s oil refinery industry suggests that ‘the changes in domestic refining capacity to date will not impact on Australia meeting its liquid fuel requirements. There are reliable, mature and highly diversified international fuel supply chains, which provide Australia with economic security.’ The Daily Reckoning Australia asked:

‘Would you be paranoid for arguing that a country should not trust its energy security to foreign trade?’